Live Market Feed

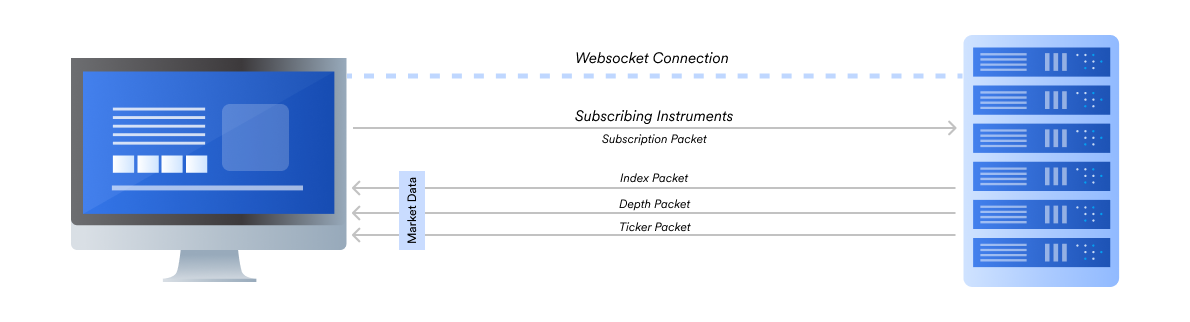

Real-time Market Data across exchanges and segments can now be availed on your system via WebSocket. WebSocket provides an efficient means to receive live market data. WebSocket keeps a persistent connection open, allowing the server to push real-time data to your systems.

All Dhan platforms work on these same market feed WebSocket connections that deliver lightning fast market data to you.

You can establish upto five WebSocket connections per user with unlimited instruments on each connection.

All request-response messages over WebSocket are in Binary. You will require WebSocket library in any programming language to be able to use Live Market Feed along with Binary converter.

Using DhanHQ Libraries for WebSockets

- You can use DhanHQ Python Library to quick start with Live Market Feed.

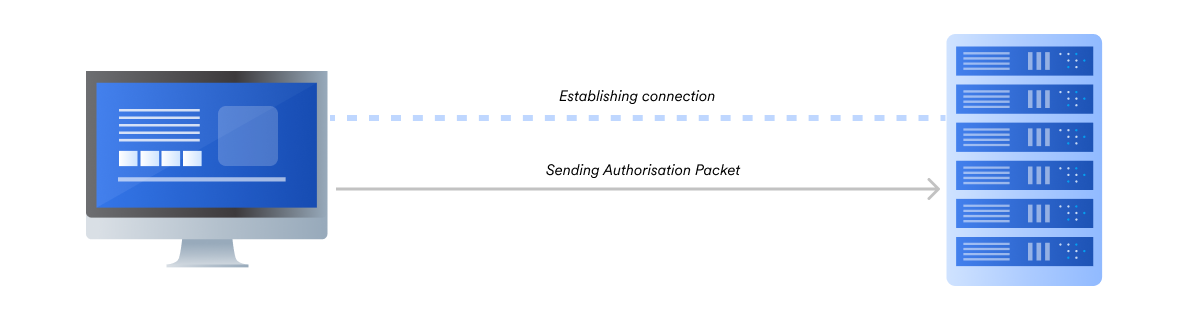

Establishing Connection

To establish connection with DhanHQ WebSocket for Market Feed, you can send request binary packet to the below endpoint using WebSocket library.

wss://api-feed.dhan.co

While establishing connection, you need to send Authorisation Packet in binary for each feed connection.

Understanding Binary Message

Binary messages consist of sequences of bytes that represent the data. This contrasts with text messages, which use character encoding (e.g., UTF-8) to represent data in a readable format. Binary messages require parsing to extract the relevant information.

The reason for us to choose binary messages over text or JSON is to have compactness, speed and flexibility on data to be shared at lightning fast speed.

All requests on Dhan consists of Header and Payload. Header for every request message remains the same, while the payload can be different.

Request Header

The header message is of 83 bytes which will remain same as part of all the requests messages. The message structure is given as below.

| Bytes | Type | Size | Description |

1 |

int8 | 1 |

Feed Request Code can be referred in Annexure

11 to connect new feed

12 to diconnect existing feed

|

2-3 |

int16 | 2 |

Message Length of the entire payload packet |

4-33 |

[ ] byte | 30 |

Client ID - User specific identification generated by Dhan |

34-83 |

[ ] byte | 50 |

Dhan Auth - to be passed as zero |

Authorisation

Authorisation Packet will consist of the following binary message which will also include Header as given above.

| Bytes | Type | Size | Description |

0-83 |

Header | 83 |

Binary Header message as specified above |

84-583 |

[ ] byte | 500 |

API Access Token |

584-585 |

[ ] byte | 2 |

Authentication Type - 2P by default |

Bytes in Binary Message Structure

In binary message structure, if the request parameter value does not consume the entire byte size, you will still be required to send the entire byte size as specified for the receiving server to read the request message.

For example, in case of Client ID of 10 digit, you need to convert it to binary message of 30 bytes. In case the byte size is less, you can add zeroes to ensure byte size remains same.

Adding Instruments

You can subscribe unlimited instruments in a single connection and receive market data packets. For subscribing, this can be done using Bulk Subscribe request which is default method of subscribing upto 100 instruments in single request over Live Market Feed.

Request Structure

| Bytes | Type | Size | Description |

0-83 |

Header | 83 |

Binary Header message as specified above.

Refer to enum to subscribe to required packet type |

84-87 |

int | 4 |

Number of Instruments to subscribe |

88-2187 |

[ ] byte | 2100 |

100 packets of 21 bytes each for each instrument. Can be passed as zero for bytes which is not utilised |

Each packet of 21 bytes should be in the followings structure:

| Bytes | Type | Size | Description |

0-1 |

int8 | 1 |

Exchange Segment of the instrument

Refer to enum for values |

2-21 |

[ ] byte | 20 |

Security ID - can be found here |

Keeping Connection Alive

To keep the WebSocket connection alive and prevent it from closing, the server side uses Ping-Pong module. Server side sends ping every 10 seconds to the client server (in this case, your system) to maintain WebSocket status as open.

In case the client server does not respond for more than 40 seconds, the connection is closed from server side and you will have to reestablish connection.

Feed Disconnect

In case of WebSocket disconnection due to any reason, you will receive disconnection packet, which will have disconnection reason code.

-

If more than 5 websockets are established, then the first socket will be disconnected with

805with every additional connection. -

Authorisation is done asynchronously after the websocket is connected. If the authorisation fails, then the socket is closed later.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 50

Refer to enum for values |

9-10 |

int16 | 2 |

Disconnection message code |

Disconnection Message

| Code | Description |

805 |

Connection limit exceeded |

806 |

Data APIs not subscribed |

807 |

Access token is expired |

808 |

Authentication Failed - Check Client ID |

809 |

Access token is invalid |

Market Data

Like request structure while establishing connection and subscribing to instruments, the Market Feed data is also sent as structured binary packets.

DhanHQ Live Market Feed is real-time data and there are four modes in which you can receive the data, depending on your use case:

Response Header

The response header message is of 8 bytes which will remain same as part of all the response messages. The message structure is given as below.

| Bytes | Type | Size | Description |

1 |

[ ] byte | 1 |

Feed Response Code can be referred in Annexure |

2-3 |

int16 | 2 |

Message Length of the entire payload packet |

4 |

[ ] byte | 1 |

Exchange Segment can be referred in Annexure |

5-8 |

int32 | 4 |

Security ID - can be found here |

Ticker Packet

This packet consists of Last Traded Price (LTP) and Last Traded Time (LTT) data across segments.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 2

Refer to enum for values |

9-12 |

float32 | 4 |

Last Traded Price of the subscribed instrument |

13-16 |

int32 | 4 |

Last Trade Time |

Prev Close

Whenever any instrument is subscribed for any data packet, we also send this packet which has Previous Day data to make it easier for day on day comparison.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 6

Refer to enum for values |

9-12 |

int32 | 4 |

Previous day closing price |

13-16 |

int32 | 4 |

Open Interest - previous day |

Along with Previous Close packet, you will also receive Market Status packet which is a notification on WebSocket. This notifies only on market Open and Close andmessage codefor this packet is7.

Quote Packet

This data packet is for all instruments across segments and exchanges which consists of complete trade data, along with Last Trade Price (LTP) and other information like update time and quantity.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 4

Refer to enum for values |

9-12 |

float32 | 4 |

Latest Traded Price of the subscribed instrument |

13-14 |

int16 | 2 |

Last Traded Quantity |

15-18 |

int32 | 4 |

Last Trade Time (LTT) |

19-22 |

float32 | 4 |

Average Trade Price (ATP) |

23-26 |

int32 | 4 |

Volume |

27-30 |

int32 | 4 |

Total Sell Quantity |

31-34 |

int32 | 4 |

Total Buy Quantity |

35-38 |

float32 | 4 |

Day Open Value |

39-42 |

float32 | 4 |

Day Close Value - only sent post market close |

43-46 |

float32 | 4 |

Day High Value |

47-50 |

float32 | 4 |

Day Low Value |

OI Data

Whenever you subscribe to Quote Data, you also receive Open Interest (OI) data packets which is important for Derivative Contracts.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 5

Refer to enum for values |

9-12 |

int32 | 4 |

Open Interest of the contract |

Market Depth Packet

Market Depth data, upto 5 best bid - best ask, can also be subscribed on the same feed connection for all instruments across exchanges and segments.

| Bytes | Type | Size | Description |

0-8 |

[ ] array | 8 |

Response Header with code 3

Refer to enum for values |

9-12 |

float32 | 4 |

Latest Traded Price of the subscribed instrument |

13-112 |

Market Depth Structure | 100 |

5 packets of 20 bytes each for each instrument in below provided structure |

Each of these 5 packets will be received in the following packet structure:

| Bytes | Type | Size | Description |

1-4 |

int32 | 4 |

Bid Quantity |

5-8 |

int32 | 4 |

Ask Quantity |

9-10 |

int16 | 2 |

No. of Bid Orders |

11-12 |

int16 | 2 |

No. of Ask Orders |

13-16 |

float32 | 4 |

Bid Price |

17-20 |

float32 | 4 |

Ask Price |